lincoln ne sales tax 2020

The auction is conducted by the county tax collector and the property is sold to the highest bidder. Browse through some important dates to remember about tax collections.

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. With local taxes the total sales tax rate is between 5500 and 8000. Average Sales Tax With Local.

You can print a 10 sales tax table here. Table 24 - 2020 Levels of Value per Tax Equalization and Review Commission. Where does Lincoln stand in regard is anchiserate in Lincoln Nebraska.

You can print a 725 sales tax table here. There are no changes to local sales and use tax rates that are effective July 1 2022. Sales tax rates for states counties and cities are shown here.

The Nebraska state sales and use tax rate is 55 055. 118 Market Avenue Boerne TX 78006. There is no applicable county tax or special tax.

Registration will be held in the Collectors office Room 103 at the Lincoln County Courthouse. For tax rates in other cities see Alabama sales taxes by city and county. There is no applicable special tax.

What Is Lincoln Ne Sales Tax Rate. County or City 2020 Net Taxable Sales 2019 Net Taxable Sales Percent Change 2020 Sales Tax 55 2019 Sales Tax 55 Adams 34472979 33491157 29 189601488 184201475 Hastings Comparison of July 2020 and July 2019 Net Taxable Sales for Nebraska Counties and Selected Cities Nebraska Department of Revenue. The morning of the sale.

The taxpayer has the opportunity to pay the taxes in full prior to the sale and a very high percentage is paid after advertising and before the sale. In Lincoln Nebraska the combined sales tax rate in 2021 will be 7 percent. The Wise County Tax AssessorCollector is a constitutional officer mandated by the Texas constitution elected by and directly responsible to the people.

2020 nebraska state sales tax rates the list below details the localities in nebraska with differing sales tax rates click on the location to access a supporting sales tax calculator. 800-742-7474 NE and IA. Select the Nebraska city from the list of popular cities below to.

Estimated combined tax rate 550 estimated county tax rate 000 estimated city tax rate 000 estimated special tax rate 000 and vendor discount 0025. There are sales tax rates for each state county and city here. There are a total of 295 local tax jurisdictions across the state collecting an average local tax of 055.

Atascosa county auto auction. 2019-2020 Lincoln County Statement of Taxes. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit.

Pay or View Property Tax. Sales and Use Tax Rates Effective October 1 2020 Sales and Use Tax Rates Effective October 1 2020 Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2.

In Lincoln another 15 percent or one and a. The County sales tax rate is. For tax rates in other cities see Nebraska sales taxes by city and county.

Table 21 - Public Power District in Lieu Taxes Other in Lieu Taxes Paid in 2020. Table 22 - 1994 to 2020 Car Line Air Carrier Taxes Distributed to Counties. The sales tax jurisdiction name is Lincoln Center which may refer to a local government division.

1 lower than the maximum sales tax in AL. The December 2020 total local sales tax rate was also 7000. 025 lower than the maximum sales tax in NE.

31 rows The state sales tax rate in Nebraska is 5500. Table 23 - 1994 to 2020 History of School Adjusted Value State Totals. Registration begins at 800 am.

You can print a. The 10 sales tax rate in Lincoln consists of 4 Alabama state sales tax 1 Talladega County sales tax and 5 Lincoln tax. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent.

This is the total of state county and city sales tax rates. For Year Ending June 30 2020 ASSESSMENT ROLL OF 2019-2020. Buyers must be present to bid.

A total of 7 per cent of Lincoln Nebraskas total sales taxes is required in 2021. How much more does Lincoln County charge than the rest of er rate in Lincoln Nebraska. Nebraska has recent rate changes Thu Jul 01 2021.

There are no changes to local sales and use tax rates that are effective January 1 2022. Pay or View your Lancaster County Property Taxes. With an annual combined sales tax rate of 7 in Lincoln Nebraska the 2020 tax rate will be 7 percent.

The Lincoln sales tax rate is. The 85 sales tax rate in Lincoln consists of 65 Kansas state sales tax 1 Lincoln County sales tax and 1 Lincoln tax. States counties and cities have various sales tax rates listed here.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. There is no applicable special tax. Back in February two major streets in Lincoln were riddled with potholes before getting re-paved with money from the quarter-cent sales tax.

Nebraska Department of Revenue. The Nebraska sales tax rate is currently. You can now make Property Tax payments Real Estate and Personal Property electronically through your bank or a bill payment service of your choice.

Lotm Frequently Asked Questions City Of Lincoln Ne

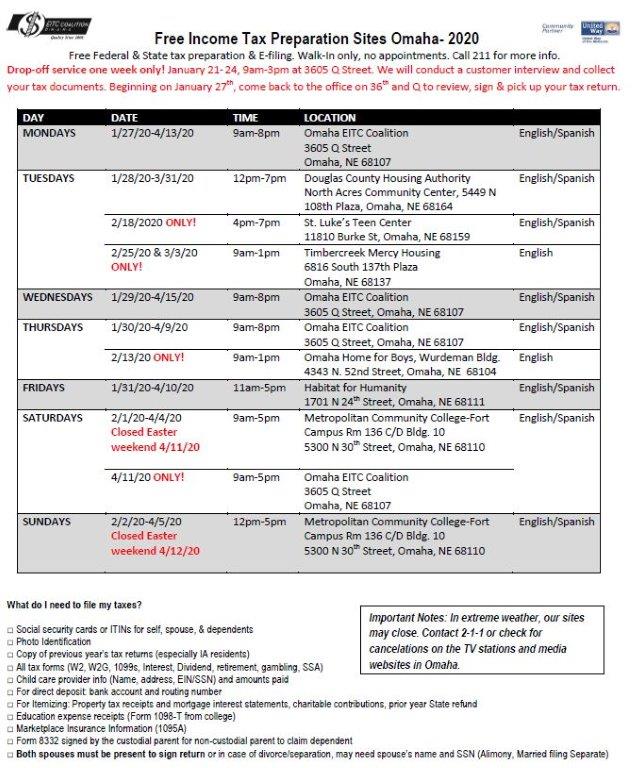

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

3318 Ne Peerless Pl Portland Or 3 Beds 1 5 Baths Redfin Real Estate House Styles

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

2020 Nebraska Property Tax Issues Agricultural Economics

See This Home On Redfin 1743 Colfax St Blair Ne 68008 Mls 21911604 Foundonredfin Colfax House Prices Hardwood Bedroom Floors

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

10136 Queensland Rd West Des Moines Ia 50266 Mls 600593 Zillow Ranch Homes For Sale House Colors Hardy Plank Siding

General Fund Receipts Nebraska Department Of Revenue

General Fund Receipts Nebraska Department Of Revenue

Nebraska Ended Fiscal Year With More Revenue Than Expected

Best Visa Credit Cards Of June 2020 Cnbc Visa Platinum Card Visa Credit Visa Credit Card